If you’re paying into a workplace pension, there’s a good chance your money is invested in the scheme’s default fund. In fact, various sources (Royal London, DWP, Nest) say that over 90% of people stay invested in their employer’s chosen default fund.

For many UK employees, this happens automatically and is never reviewed. While default funds are designed to be broadly suitable, they are not personalised — and in some cases, they can significantly limit the long-term growth of your pension.

As a UK Independent Financial Adviser and Planner, this is an issue I see regularly when reviewing new clients’ pensions. So before we get into the topic let’s break it down.

What Is a Workplace Pension Default Fund?

A default fund is where your workplace pension contributions are invested if you don’t actively choose an alternative option.

Both your own contributions and your employer’s contributions are automatically invested into this fund(s) when you join a company pension scheme.

Default funds are designed to suit the average employee, balancing growth and risk across a wide range of ages.

The default fund usually follows what’s known as a lifestyle strategy. The idea is that when you’re younger and further away from retirement, your money is invested more heavily in growth assets like equities.

As you get closer to retirement, the fund gradually moves into less volatile assets like bonds and sometimes cash. This is designed to reduce day to day ups and downs as you approach the point where you might start taking money out.

However a common issue with workplace pension default funds is that they often hold too much in lower-volatility assets, such as bonds for those many years away from retirement or even people in retirement.

Many default funds for employees more than 15 years from retirement are invested roughly 60–70% in equities and 30–40% in bonds. While this can reduce short-term volatility, it can also limit long-term growth.

A Real Example: The Impact of Staying in the Default Fund

A client I recently worked with (we’ll call him Sam) is 32, earns £35,000, contributes 5% to his workplace pension, and his employer contributes 3%. That means each year, £2,800 goes into his pension, and we’ll assume those contributions rise with inflation.

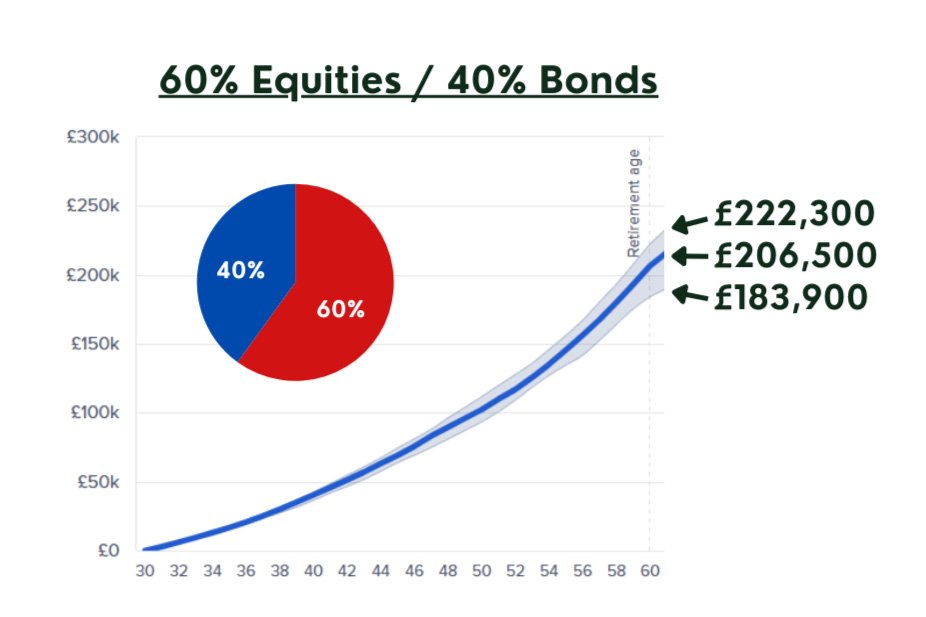

Sam’s pension was invested in a default fund with a 60% equity and 40% bond split.

Using financial planning software, historical returns of different investment types and his contributions increasing with inflation we projected forward his pension value to age 60.

Staying in the default fund produced a projected value of £206,500 in today’s money when using historical median returns of this asset mix, with a likely range between £183,900 and £222,300.

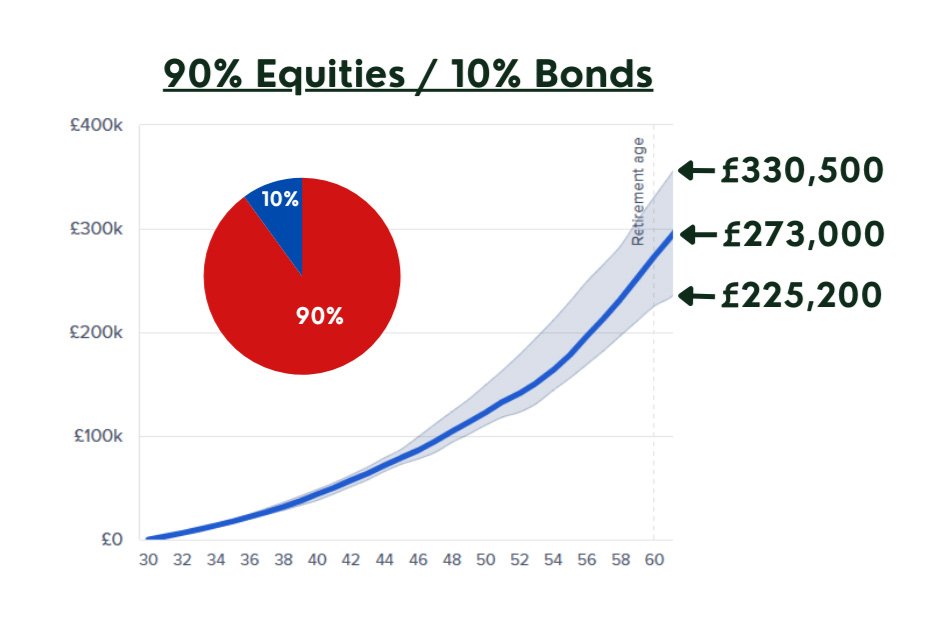

Switching to a 90% equity and 10% bond split produced a projected value of £273,000 when using historical median returns, with a likely range of £225,200 to £330,500.

That difference of over £65,000 in the median scenario could mean a retirement that’s a couple years earlier, or being able to take two holidays a year vs. barely managing one. All driven by investment choice.

Should You Change Your Workplace Pension Fund?

Not everyone should automatically move away from the default fund, but many people should at least review it.

Your pension is likely to be one of the largest assets you ever build, and taking the time to understand where it is invested, periodically review it, and make informed decisions along the way can make a huge difference to the final pot and ultimately income it provides or when you can retire.

What Should You Do Next?

Log onto your workplace pension portal and review which fund you’re invested in. How much is allocated to equities and bonds? And does this match your risk profile or work with your retirement plans?

If it doesn’t, you may want to consider making a change or, where appropriate, seek independent financial advice.

How Can We Help?

If you’re unsure whether your workplace pension is invested appropriately, a review can help clarify whether simple changes could improve long-term outcomes.

There’s no obligation — just a chance to make sure your pension is working as hard as it should be.

This content provides is for educational purposes only and does not constitute personal advice. Should you need advice, please request it. Remember that investments can go up and down in value, you may get back less than you put in.